This article gives you an effective trading strategy in Olymp Trade Fixed Time using Fibonacci retracement levels. This is an indicator used by few successful traders in the market. Stay tuned to see what you can do with Fibonacci in Olymp Trade to make a profit.

Register an Olymp Trade account NowGet $10,000 Free for beginners

Fibonacci indicator and efficiency in trading

In trading, there is a famous saying about Fibonacci retracement levels as follows: “Fibonacci retracement is the only tool that can identify the psychological level of the market.” In terms of psychology, the price path represents the sentiment of market participants (buying and selling sides). Fibonacci ratios are a special ratio that occurs in many fields of life: Shells, flowers, body proportions, etc. And especially, the measure of market sentiment also follows this ratio.

In simple terms, Fibonacci allows you to define the psychological levels of the market. It helps to detect reversal points, troughs, peaks usually located at Fibonacci levels. From there, when the price comes into contact with these price zones, you will act more accurately.

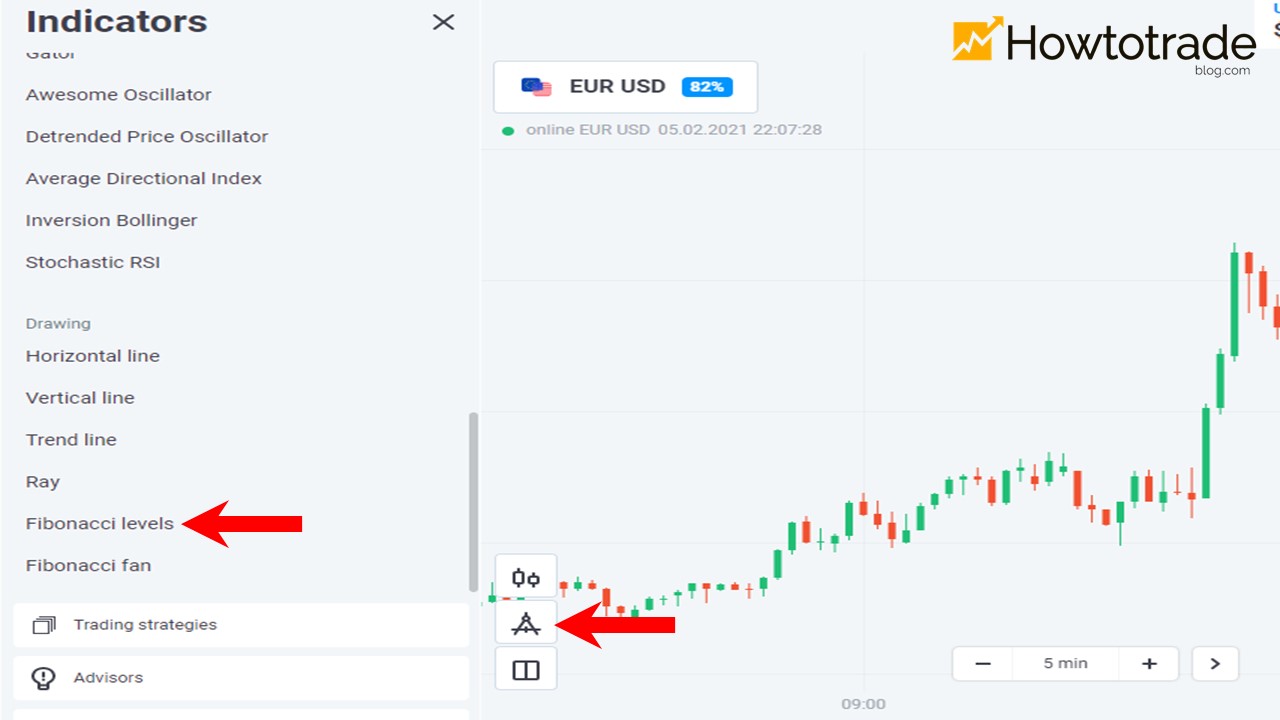

How to set up the Fibonacci Retracement indicator in Olymp Trade

To set up this indicator in Olymp Trade, do the following:

- Select the “Indicators” menu and then navigate to “Fibonacci Levels”.

- Set the Fibonacci indicator from the bottom (1) to the top (2) of a bull cycle. Then, the levels depending on the Fibonacci ratios will appear.

How to trade Fixed Time effectively with Fibonacci Retracement indicator

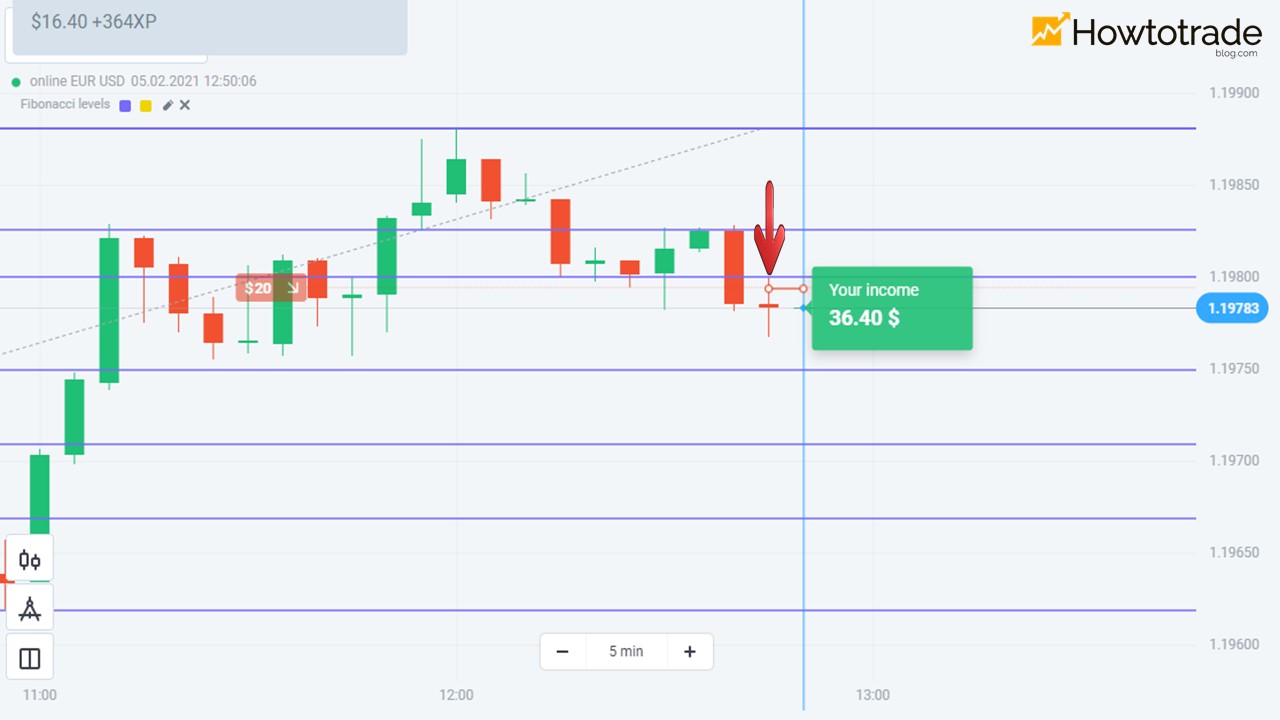

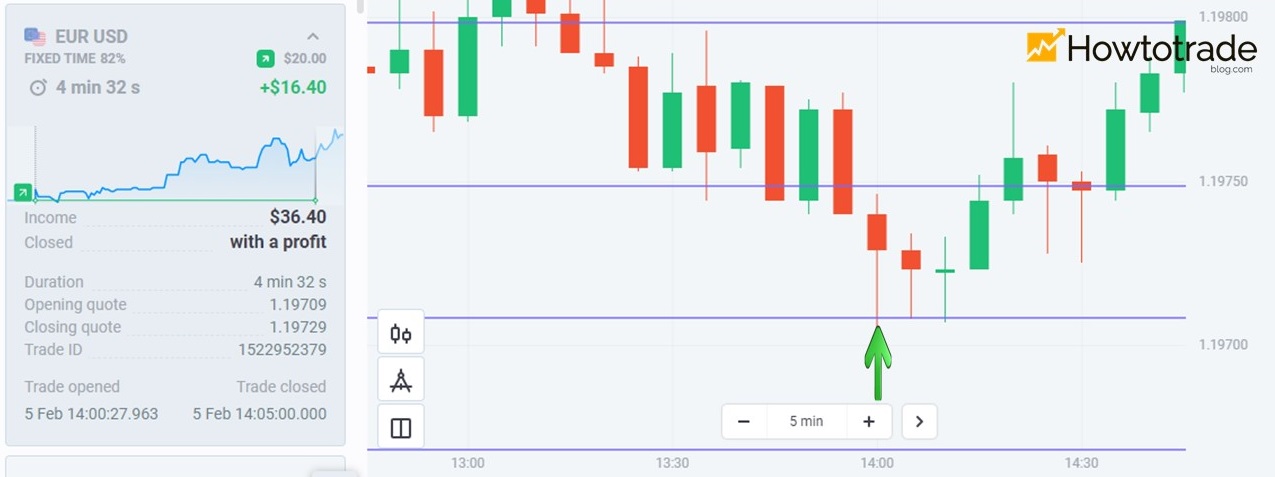

Here’s how to open Fixed Time Trade orders correctly with the Fibonacci indicator. The proof for this trading strategy is my last trading day on February 5th with a very high win rate. Here I will demonstrate this trading strategy through specific trading orders.

Trading diary on February 5th with the Fibonacci retracement in Olymp Trade

Follow the orders below to better understand how to trade with the Fibonacci indicator.

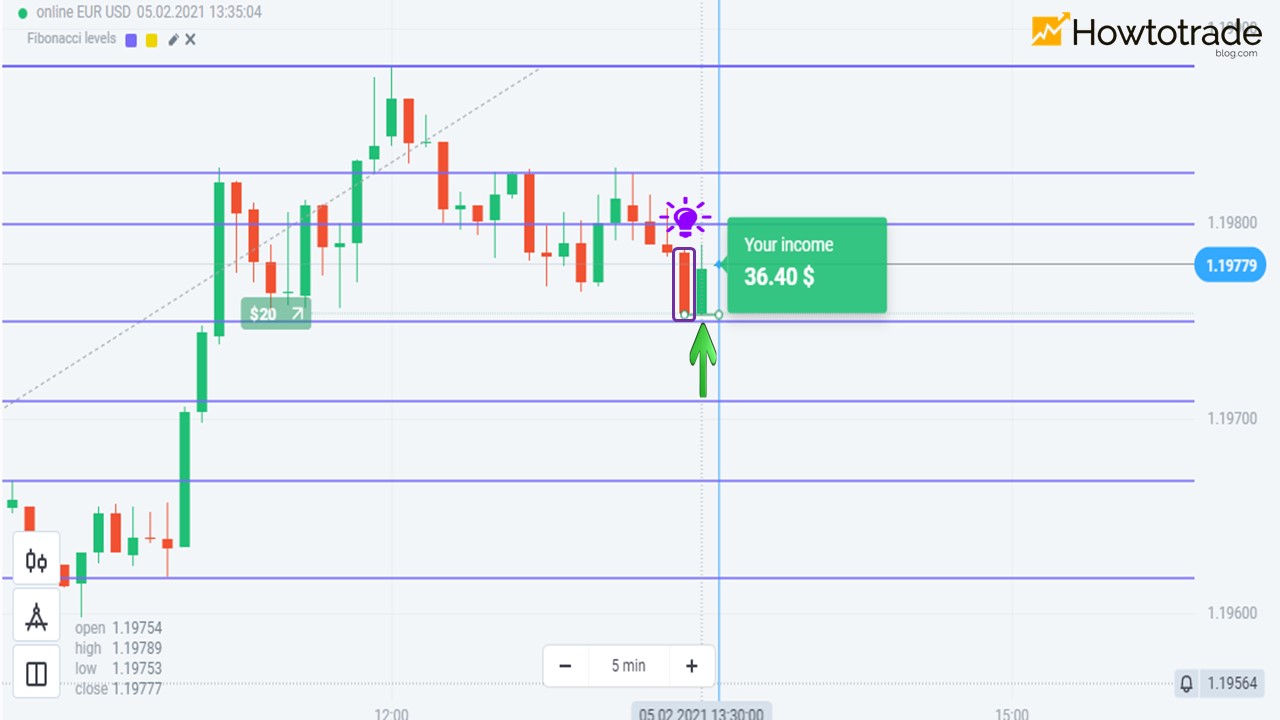

1st order: The price slowly retraced to the levels according to the Fibonacci ratios and reacted. After penetrating the 0.236 level, the price retested this level. Opened a DOWN order with the expiration time equal to the candle time period.

2nd order. The way to open this order was similar to that of the 1st order. This trading strategy is often referred to with another name that is candlestick tail/shadow/wick trading.

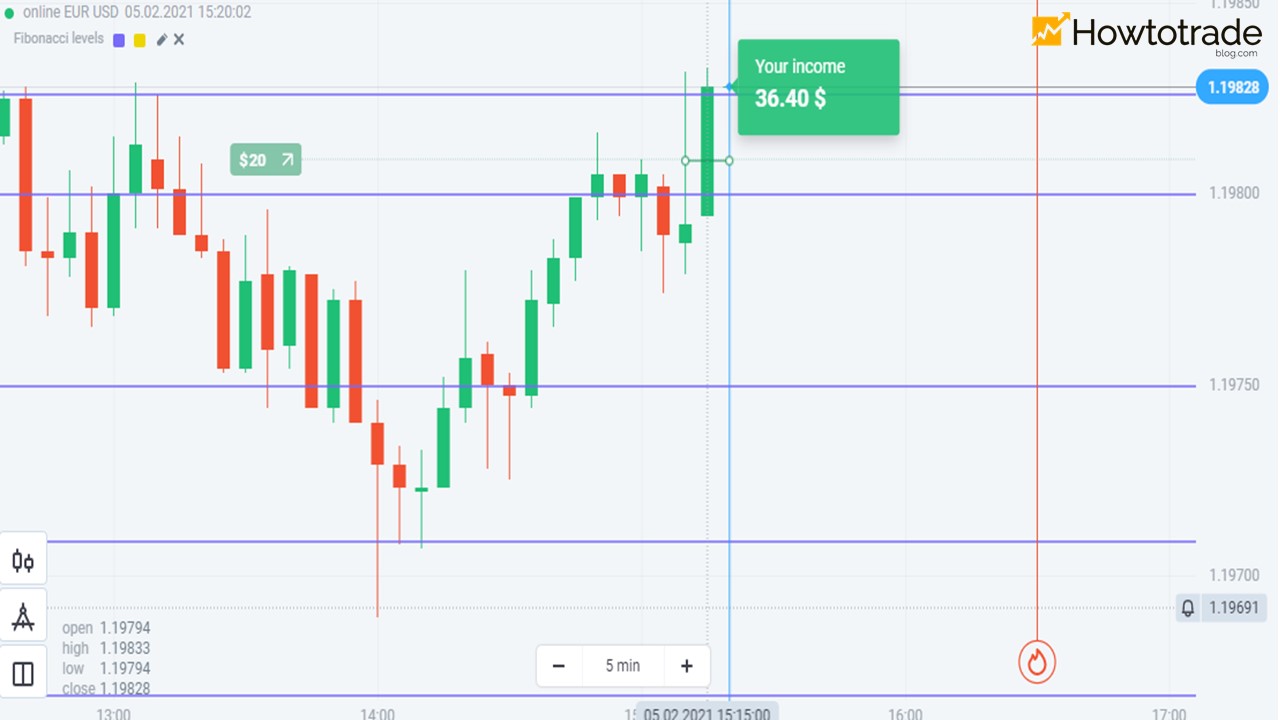

3rd order: The price continued to go down and touched the 0.382 level. According to Fibonacci, this is the level of the golden ratio which has a very special meaning. Price would react strongly here. Opened an UP order for the next candlestick.

4th order. This order was still another one opened using the candlestick tail. As soon as the price hit the 0.5 level of the Fibonacci, opened an UP order with the expiration time equal to the candle time period.

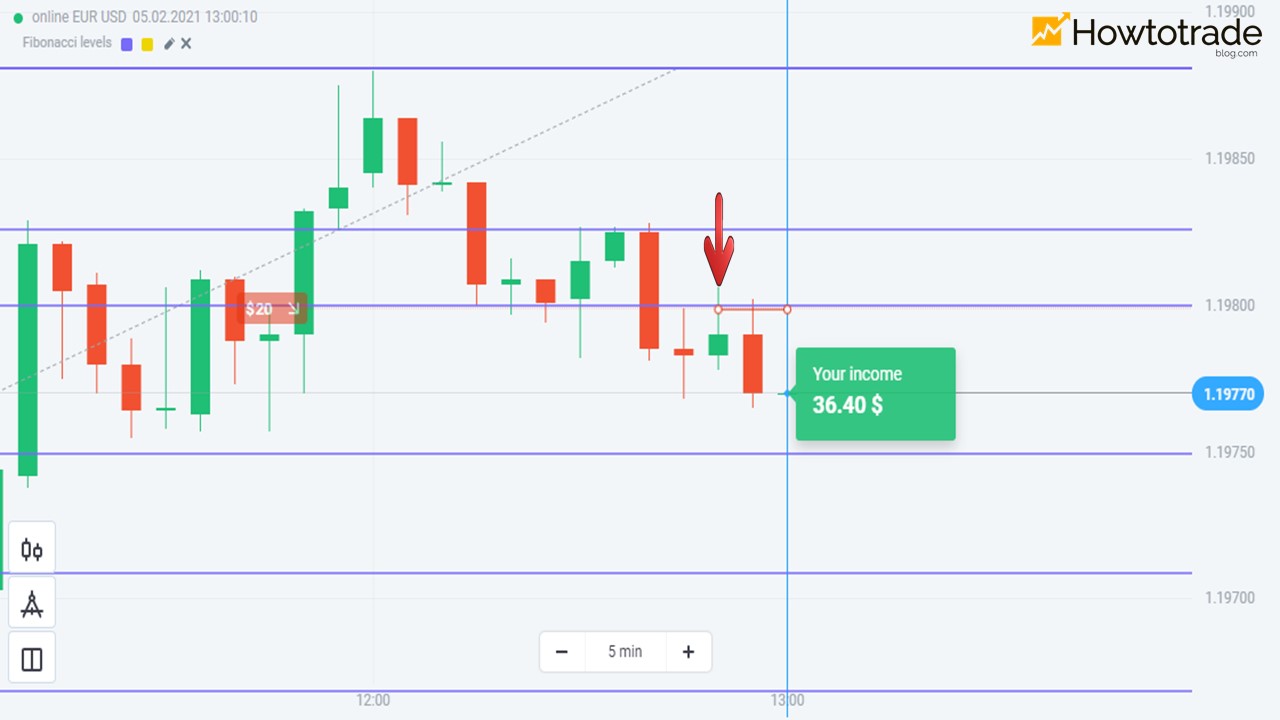

After the 4th order, the price had 3 times to hit the 0.5 level of Fibonacci and could not create a deeper bottom => The downtrend was broken; the price might rise again. Waited for opening an UP order.

5th order. This is an order opened in a slightly different way from the above. After breaking through the Fibonacci level, the price returned to test this level. Opened an UP order until the next candlestick ended.

Some notes when trading Olymp Trade using Fibonacci levels

Now you understand how to trade effectively with the Fibonacci indicator in Olymp Trade, don’t you? This is how to open an order using candlestick tails which is very good when the price reacts strongly to levels. In addition, you need to keep in mind some of the following notes to make this strategy more effective:

+ Identify 1 major trend exactly before drawing the Fibonacci levels. This is very important. Because if there is no trend, the signal will be very noisy.

+ Levels of 0.236, 0.382, and 0.5 are levels that price will offer the best response. Please focus and look for opportunities to open orders in these zones.

+ When the price crosses the Fibonacci 0.5 level, there is a high possibility that the price will continue the current trend. If it cannot cross, it is highly likely that it will reverse and continue the original trend.

Summary

Get familiar with this trading strategy using candlestick tails and you will find it very good to apply in Fixed Time Trade. As for Fibonacci, there will be many more uses that I will bring up in the following articles. Goodbye and wish you a successful transaction.

Register an Olymp Trade account NowGet $10,000 Free for beginners