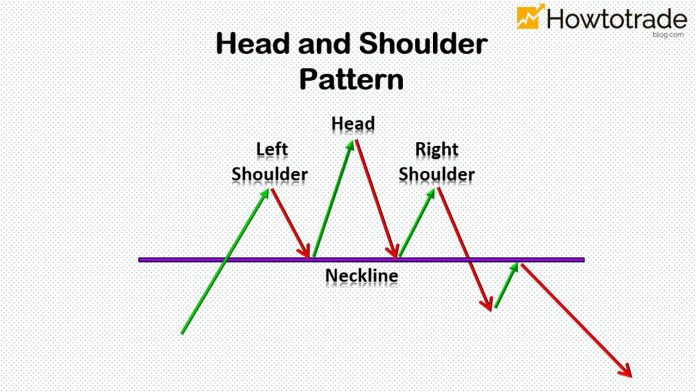

The Head and Shoulders pattern is one of the most popular and best-known price patterns in Forex trading. In this article, Howtotrade blog will guide you on how to verify and trade effectively with this pattern.

This is a very accurate trading signal if you know how to use it properly and flexibly.

Register an IQ Option account NowGet $10,000 Free for beginners

What is Head and Shoulders? How to identify and characterize

Head and Shoulders is the name of a special type of price pattern that usually appears at the end of uptrends. This is a signal of future downtrends.

It is called Head and Shoulders because the shape of this pattern on the price chart is similar to that of the human body including Left Shoulder, Head, and Right Shoulder.

The line connecting the two troughs of the shoulders is often called the neckline. In fact, this pattern is perfect when the Neckline is horizontal (the prices of the two lows are approximately the same).

Normally, when the pattern appears, the market will offer a Retest (Pull-back) point. If you do not understand what Retest is, please review the article: What is Retest? Why is it so magical.

This pattern has the following characteristics:

+ The stronger the price increases before the pattern, the stronger the price falls after it.

+ The faster the price increases before the pattern, the faster the price falls after it.

+ The variation with a neckline pointing upwards offers the highest accuracy.

+ Left shoulder higher than right shoulder yields better performance.

A practical example of the pattern.

Common types of Head and Shoulders patterns

A perfect Head and Shoulders pattern rarely appears. Therefore, traders usually consider the variations of this price pattern. Here, I will introduce to you the other two popular remaining types. These are the patterns with an upward neckline or a downward neckline. Let’s take a closer look at the images below.

The variant pattern with an upward neckline

This is a variant with an upward neckline. This price pattern offers the highest accuracy among all Head and Shoulders patterns.

An example of the variant pattern with an upward neckline.

The variant pattern with a downward neckline

Similarly, we also have another variant with a downward neckline. Then, the neckline will look like a trendline in a downtrend. You need careful observations to identify this pattern.

A practical example of the pattern with a downward neckline.

How to trade Forex and binary options

Trade Forex with a Head and Shoulders pattern

I will show you in great detail how to trade Forex with this pattern. Entry points, stop-loss, and take-profit to maximize profits are also available. Please take a look at the example below to learn more about how to enter a Forex trade with this pattern.

Since this is a pattern signaling a price decrease in the future, you should only open DOWN orders with this pattern.

+ ENTRY POINT: Right after the candlestick breaks out of the neckline.

+ STOP-LOSS: At the peak of the right shoulder.

+ TAKE-PROFIT: Usually, Head and Shoulders is a pattern for starting a downtrend. Therefore, instead of setting a take-profit, you can adjust your stop-loss when the price falls. The lower the price is, the lower your stop-loss you should adjust. This is to maximize your profits and protect your final results.

Trade binary options with a Head and Shoulders pattern

In Binary Options trading you can observe the 5-min, 10-min price charts to look for Head and Shoulders patterns. With this type of trading, the safest entry point is the retest point at the neckline.

Requirements: A long expiration time (If you use the 5-minute Japanese candlestick chart to analyze the market, the expiration time for a binary options order should be between 30 and 45 minutes.)

How to open an order

+ Open DOWN orders: The price retests the neckline of the pattern.

To conclude

The Head and Shoulders pattern is a favorite signal of price action traders. This is a strong signal for you to open trendy Sell positions. Often, the Head and Shoulders warns traders of a strong downtrend in prices.

In the article, I used pictures taken from the Olymp Trade trading platform. This is a platform that offers 2 forms of trading: Forex and Binary Options (Fixed Time Trade). You can open a demo account here:

Register an Olymp Trade account NowGet $10,000 Free for beginners