The Three Inside Down candlestick pattern is a set of three candlesticks that signals a reverse from up to down in the Forex market. This is a set of three Japanese candles widely used in trading. Within the scope of today’s article, we will introduce to you this special candlestick pattern.

Register an Exness account NowGet $1,000 Free for beginners

What is the Three Inside Down candlestick pattern?

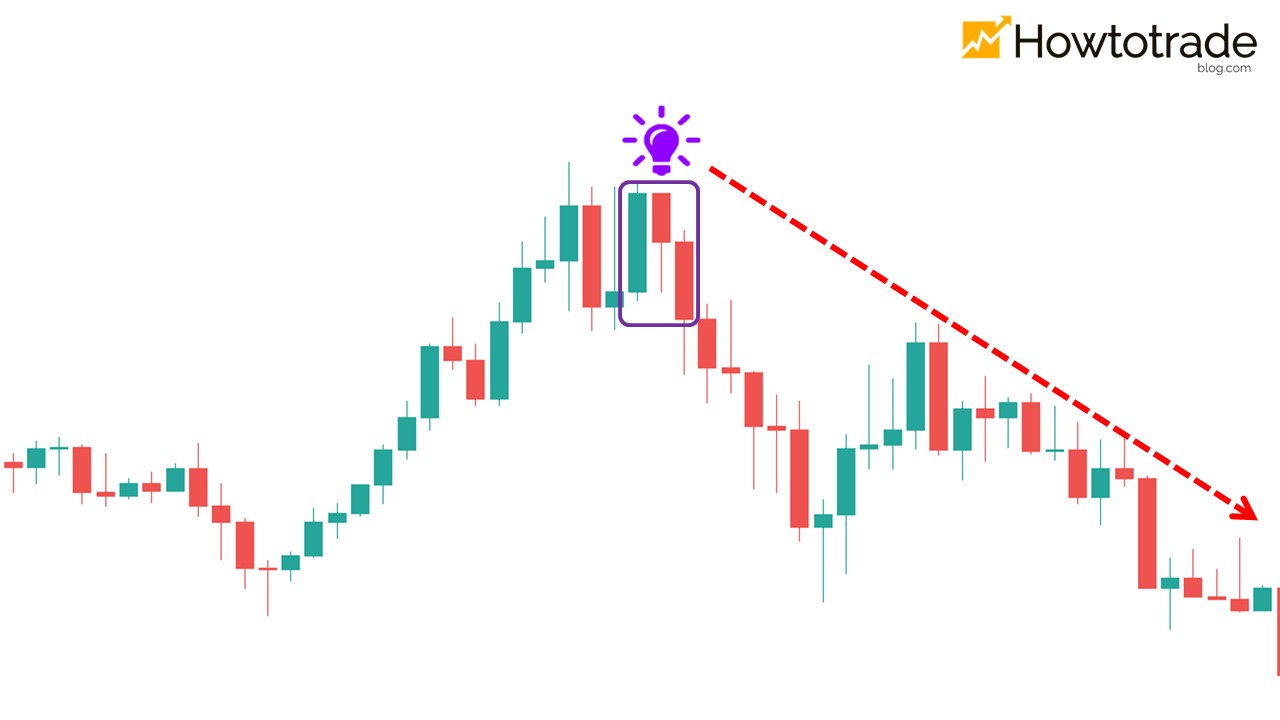

The Three Inside Down candlestick pattern is a special Japanese candlestick pattern in Forex. It usually appears at the peaks of the price. Like other bearish reversal candlestick patterns, it is a warning signal for future declines.

In Forex trading, using this reliable price signal effectively will get you very precise sell orders at tops.

Structure of the pattern

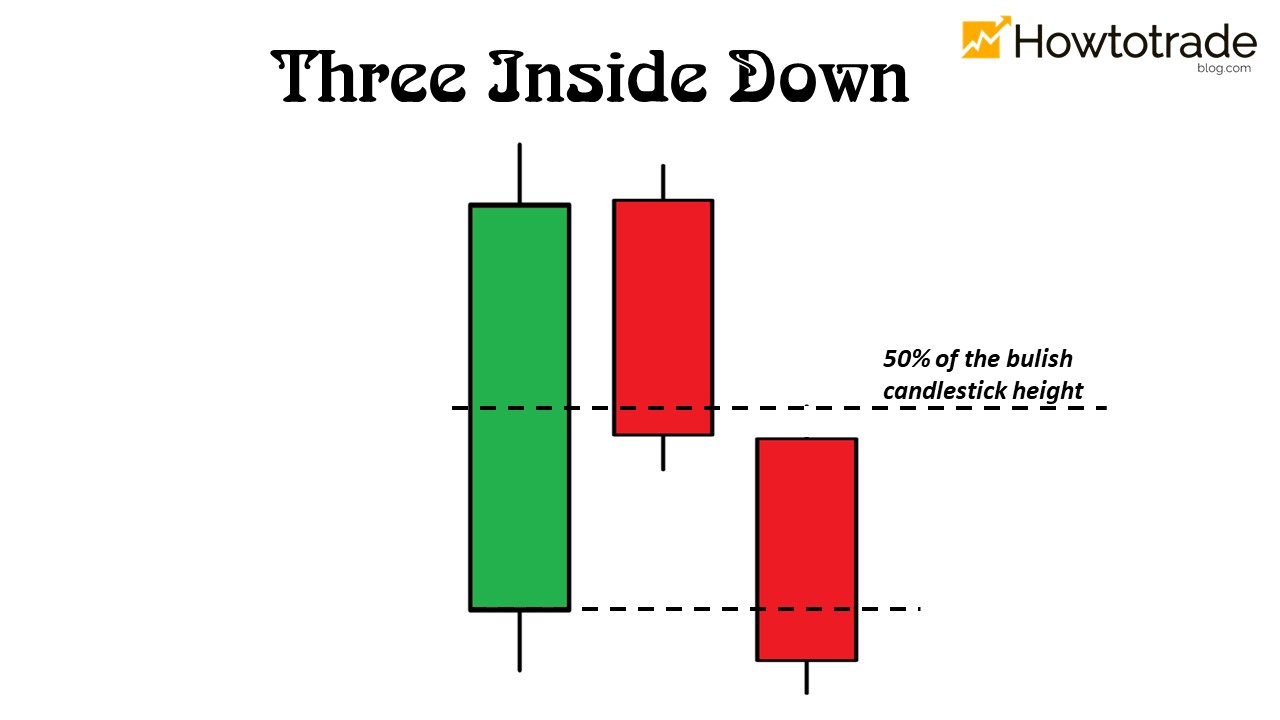

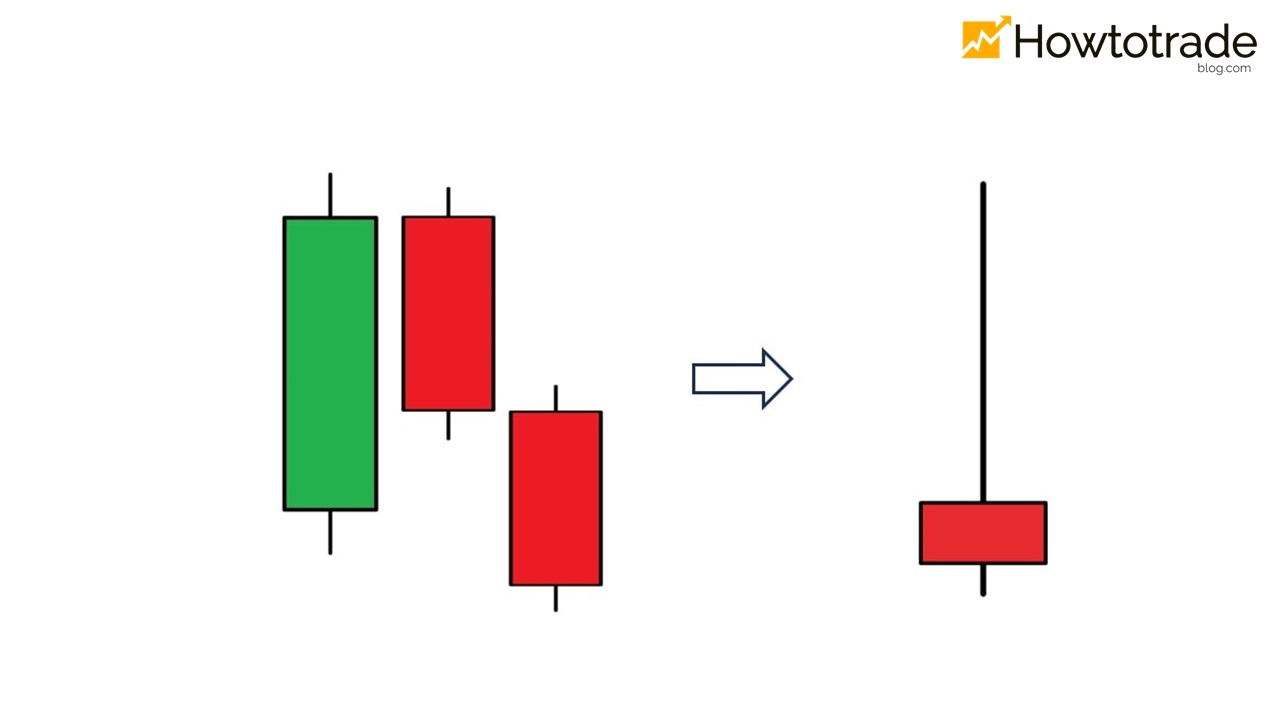

A standard Three Inside Down candlestick pattern is structured as follows:

+ The first is a strong green bullish candle.

+ The next one is a red bearish candlestick with at least half the length of the first one.

+ Last is a red candle of which the closing price is lower than the opening price of the first candle.

Variant candlestick patterns

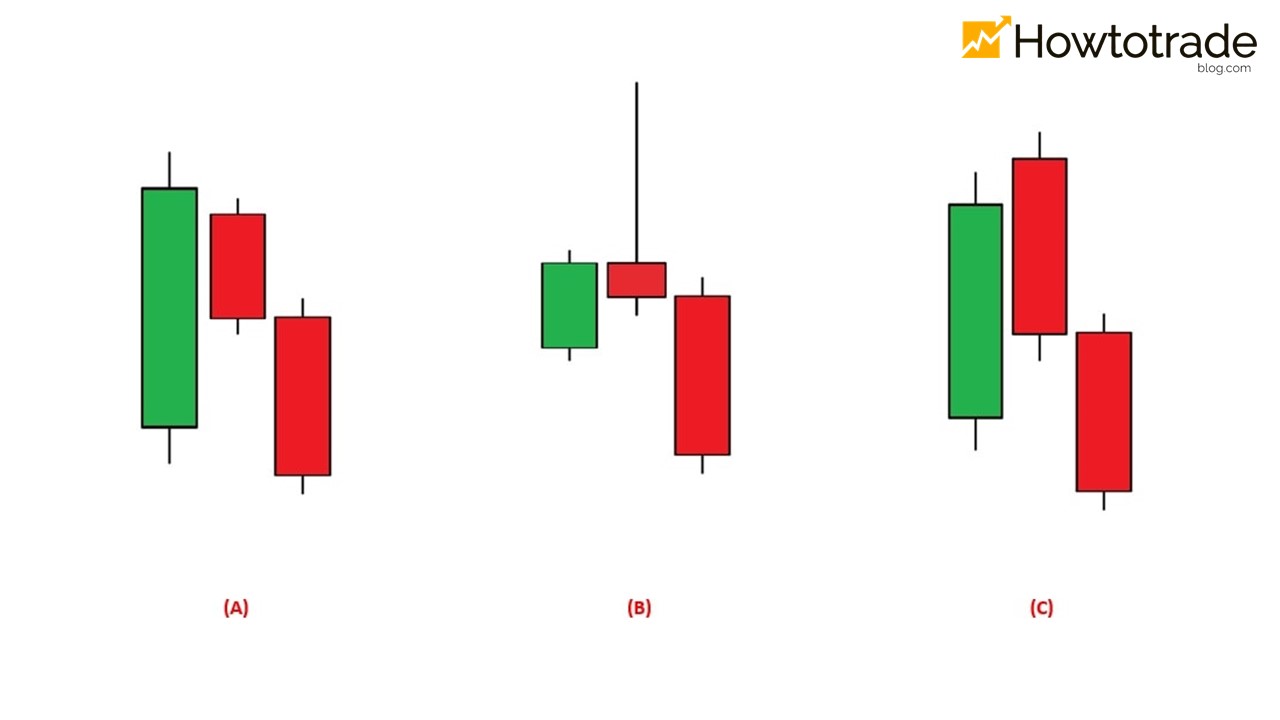

The variants of Three Inside Down are also carefully considered when analyzing the price chart. Each variant has a different shape. Depending on the second candle in the pattern, we have the following variants of candlestick patterns:

(A) The pattern in which the first 2 candles form the Bearish Harami candlestick pattern.

(B) The pattern in which the second candle is a Pin Bar candlestick.

(C) The pattern in which the first 2 candles form a Dark Cloud Cover candlestick pattern.

Meaning of Three Inside Down candlestick pattern

It is a Japanese candlestick pattern consisting of 3 candles. Combining the 3 candles of the Three Inside Down candlestick pattern, you will get a Bearish Pin Bar (aka Shooting Star) candlestick pattern. This is a common bearish signal in Forex. This explains why it is a reliable bearish signal.

The Three Inside Down candlestick pattern warns of a price reversal from bullish to bearish. This price signal often appears at the end of uptrends and stays at the top of the market.

How to trade Forex effectively with the Three Inside Down candlestick pattern

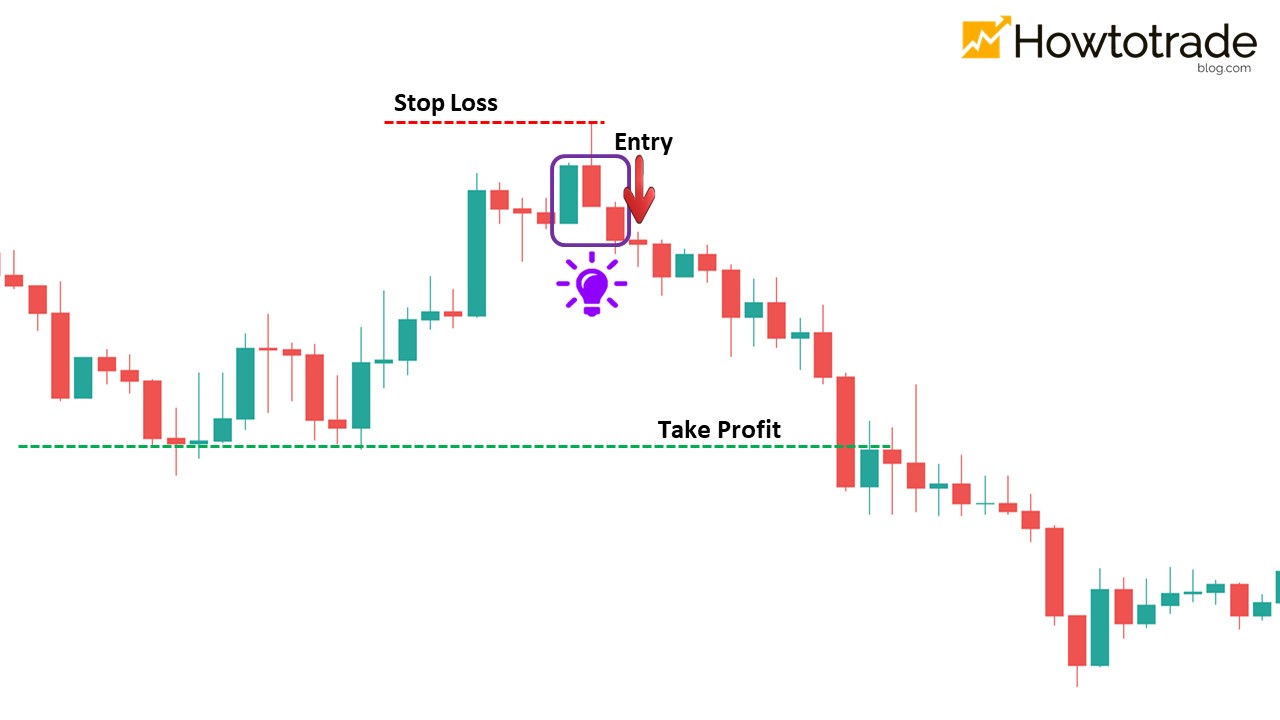

Here, I will show you how to place a basic Forex order using the Three Inside Down candlestick pattern. Please note that the Three Inside Down is a bullish to bearish reversal pattern. Therefore, you can only open SELL orders with this candlestick pattern. Open a SELL order as follows:

+ Entry Point: As soon as the price finishes creating the 3rd candlestick of the pattern.

+ Stop-Loss: At the highest price level before the price turns down and creates the pattern.

+ Take-Profit: When the price touches old support levels that have been formed in the past.

We have finished introducing another strong reversal candlestick pattern to you. Hopefully, this article will help you get acquainted and understand special reversal candlestick patterns in Forex. Goodbye and see you again.