When looking at the Japanese chart in Forex, you sometimes come across an up or down Gap. What does the appearance of that gap signal to investors?

This article will guide in detail what a Gap is. Two important types of Gaps you need to know. Meaning and how to trade Forex using a Gap.

Register an Exness account NowGet $1,000 Free for beginners

What is a Gap?

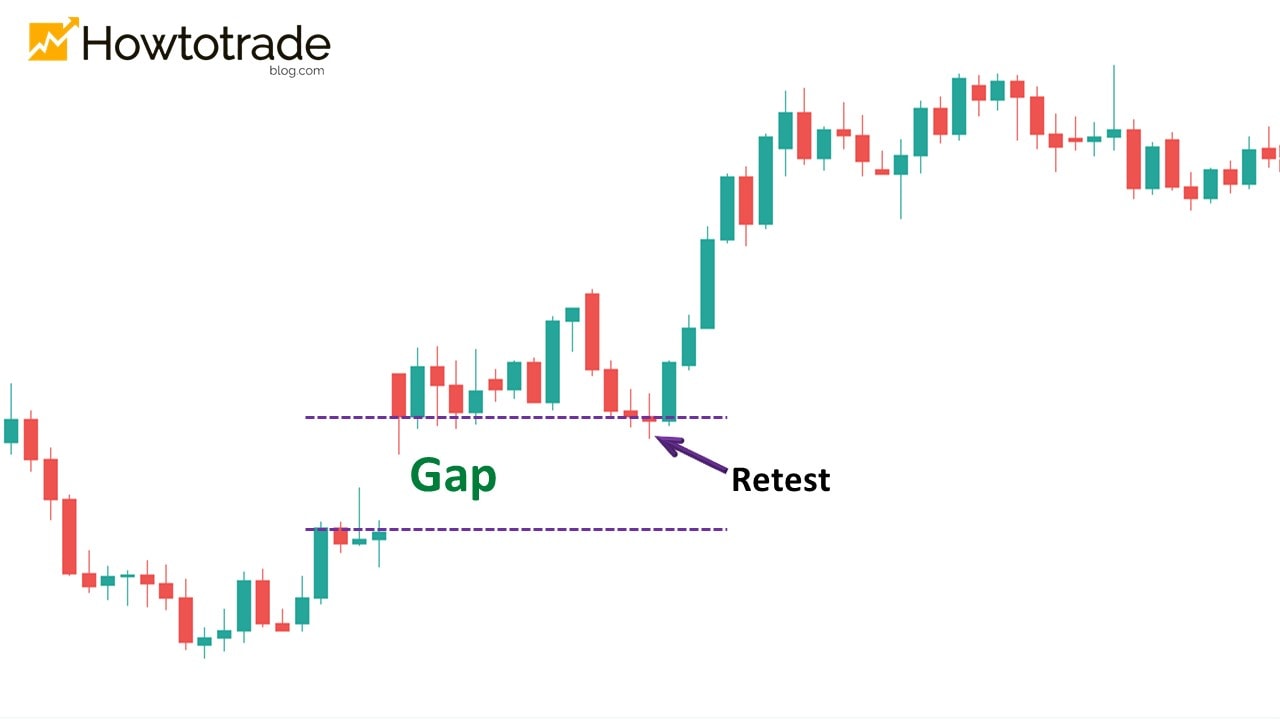

In technical analysis, a Gap (as its name) is the gap that appears when prices move sharply in the direction of increase or decrease. A Gap is the difference between the closing price of the previous candlestick and the opening price of the next candle.

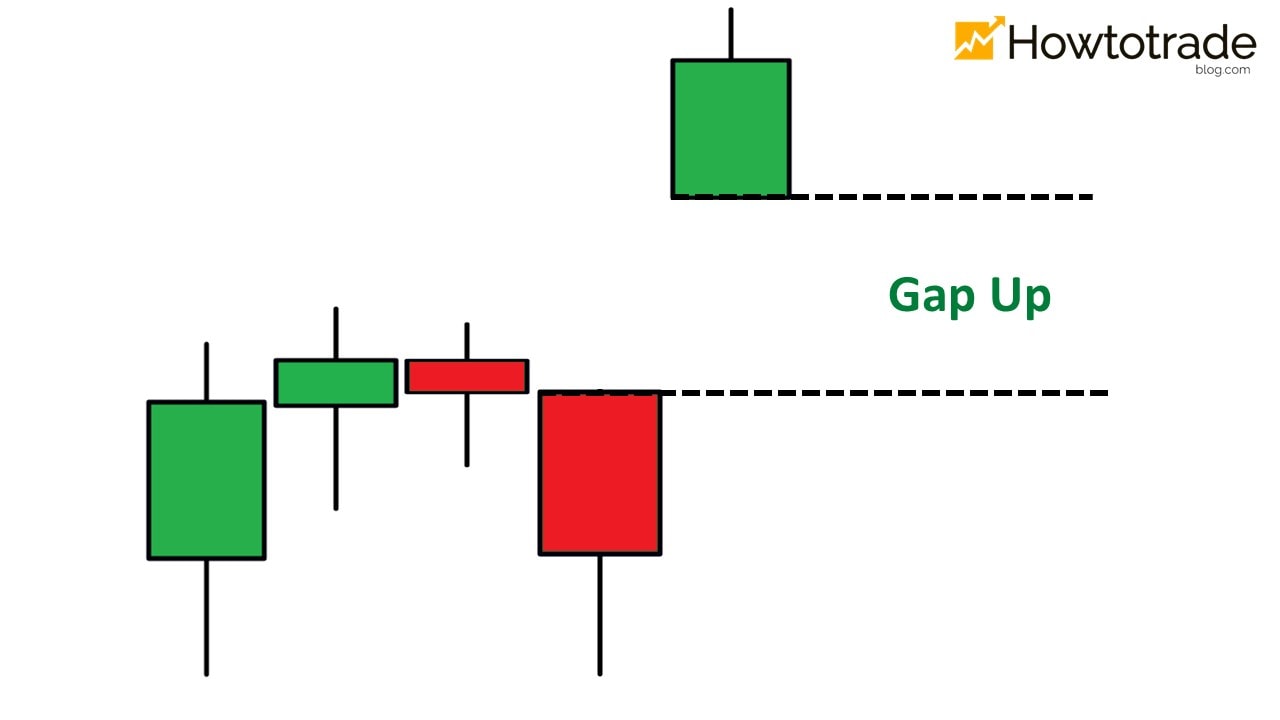

When the price bounces up sharply at the time of transition from a candlestick to another, the price gap that appears is called Gap Up.

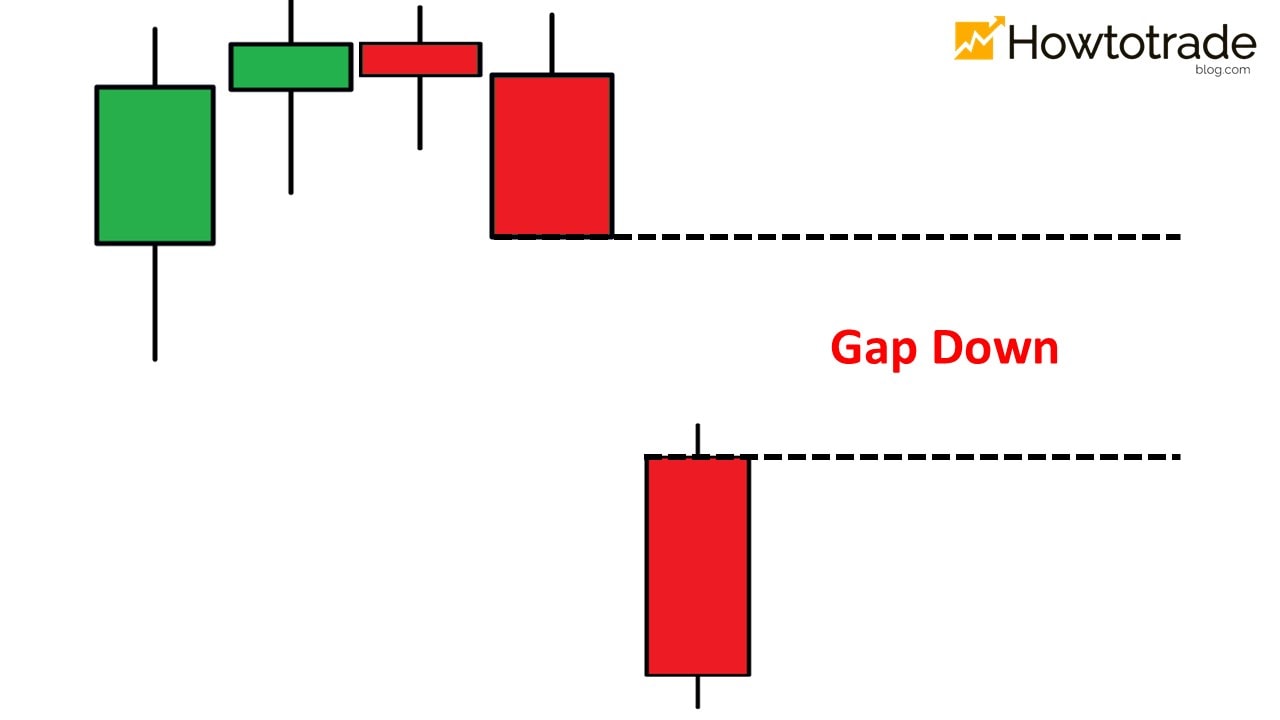

On the contrary, when the price falls sharply at the transition between candlesticks, the price gap between the closing price of the previous candle and the opening price of the next candle is called Gap Down.

Causes of the appearance of a Gap in Forex

There are several reasons for the appearance of a Gap as follows:

– On holidays of the financial market (such as Saturday and Sunday or federal holidays), there might be some big news of fluctuations. This leads to the fact that when Monday comes, there will be gaps instead of price fluctuations on weekends on the chart.

– When there is an event (bad or good news) that is extremely powerful and affects the financial market, it may cause banks to sell off a currency.

– At major holidays like Christmas or year-end, it is the time when many banks in the world stop trading. This leads to the lack of continuity in the transaction which is a condition for the Gap to appear.

Two common types of Gaps and their characteristics

There are two types of Gaps that you need to be aware of when they appear: Breakaway Gap and Runaway Gap.

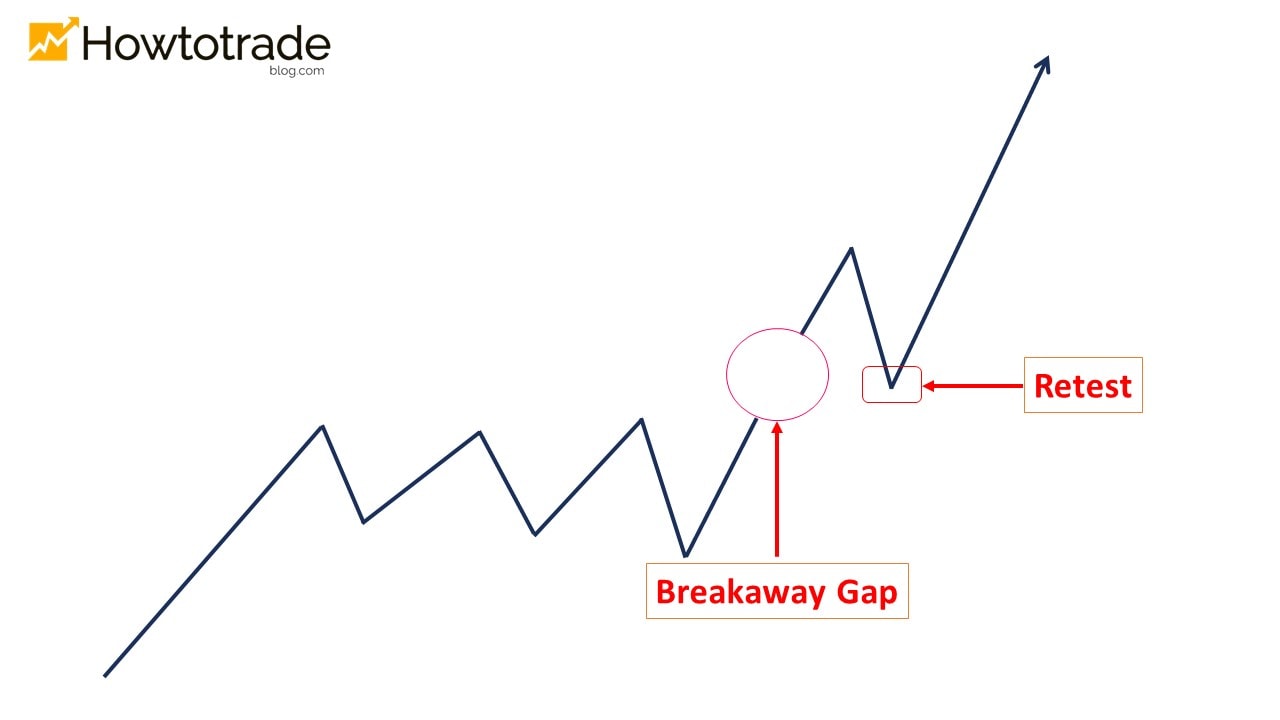

Breakaway Gap

This type of gap usually appears when the price breaks out of the support or resistance zone.

Specifically:

The price breaks out of the resistance zone by 1 gap (Gap Up). The market is likely to enter the uptrend. Also, the Gap Up becomes a Support zone for the bullish momentum of prices.

The recognizable characteristic of this type of Gap is that the price will tend to retest the Gap before developing the trend.

The same goes for the downtrend. Prices break out of the support zone by 1 gap (Gap Down) and then retest. There is a high probability that the market will enter a downtrend. And now, the Gap Down becomes a Resistance zone.

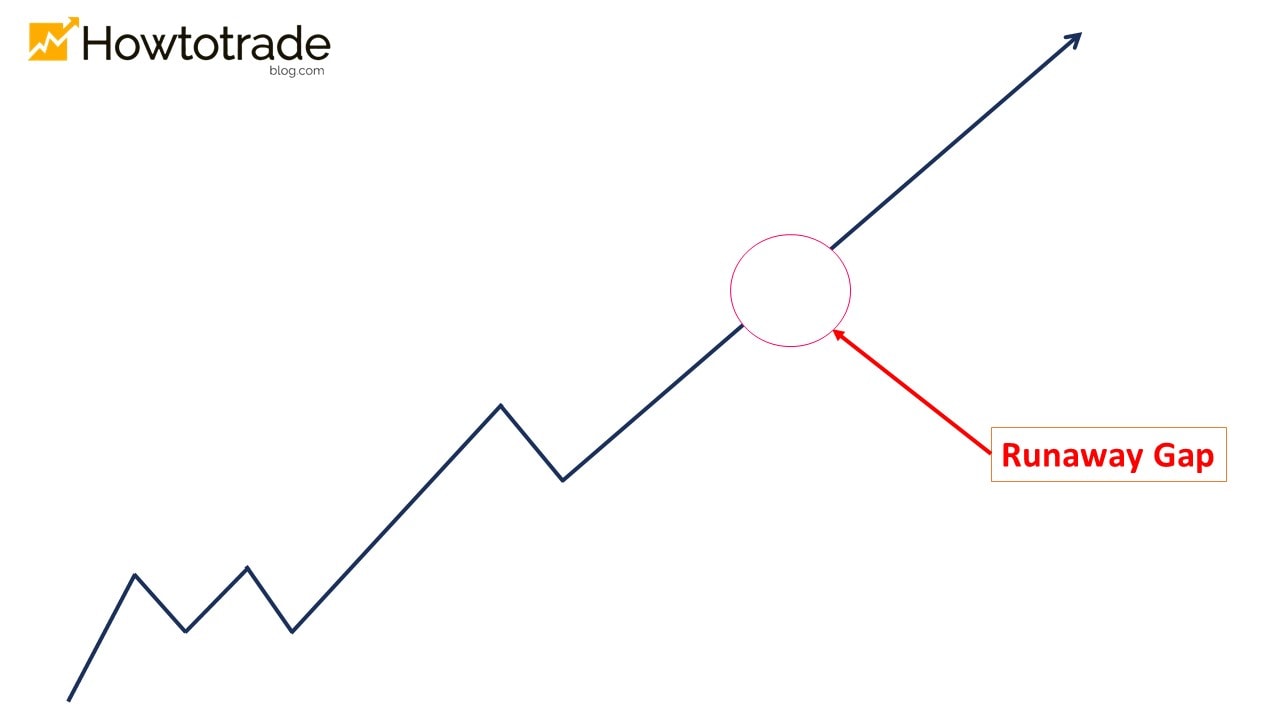

Runaway Gap

This type of Gap occurs when the price is in a trend. This gap has a smaller amplitude and signals a continuation of the trend.

Specifically, when a Runaway Gap appears in an uptrend, prices continue to rise sharply as the Gap appears.

Conversely, the price is in a downtrend, creating a price gap (Gap Down). Then, there is a high probability that the price will continue to plummet.

How to trade Forex effectively with the Gap

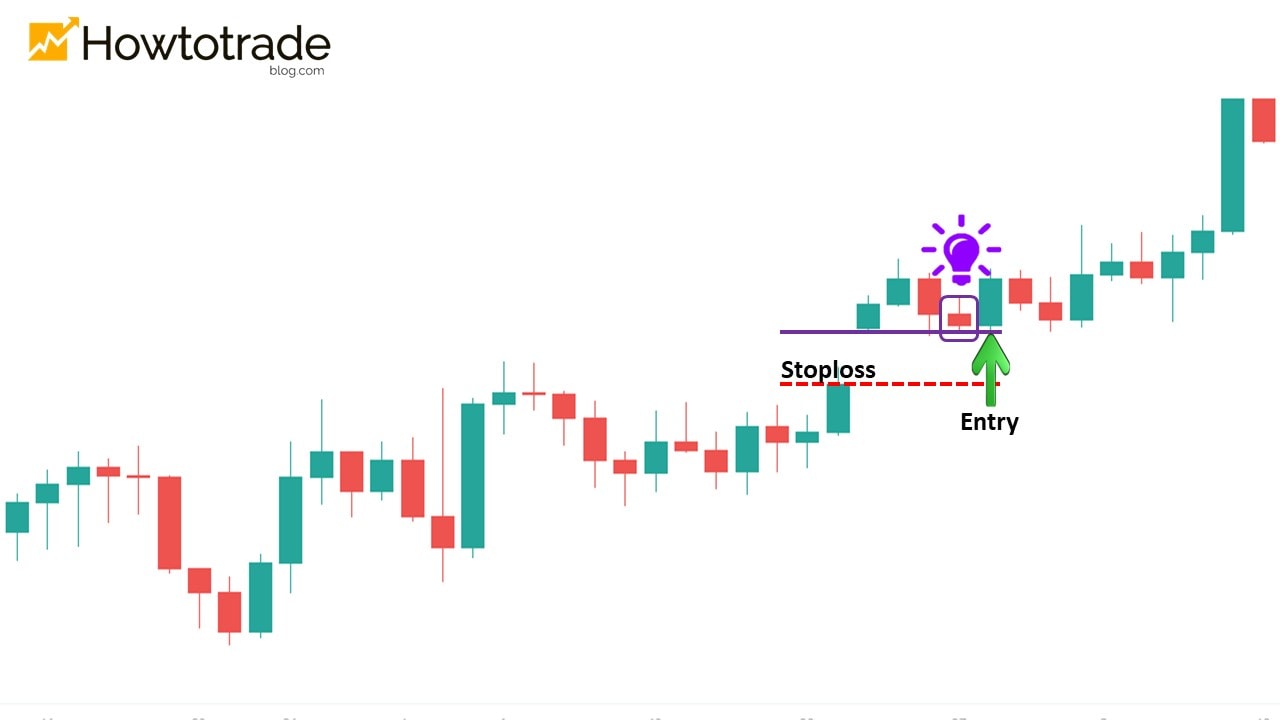

Of the 2 popular Gap types that I have just introduced, Breakaway is the Gap with very high accuracy. A lot of experienced traders make Forex trading work with this type of Gap. Retest points are reliable entry points for a Gap. Here, I will show you how to place Forex orders with this strategy.

Principles of Forex trading by price a Gap:

+ When a Gap Up appears, only open BUY orders.

+ When a Gap Down appears, only open SELL orders.

Open a BUY order with a Gap Up as follows:

+ Entry Point: When the candlestick finishes retesting the Gap.

+Stop-loss: At the lower level of the Gap Up.

+ Take-Profit: You can take profits when the price touches resistance levels that have been formed in the past.

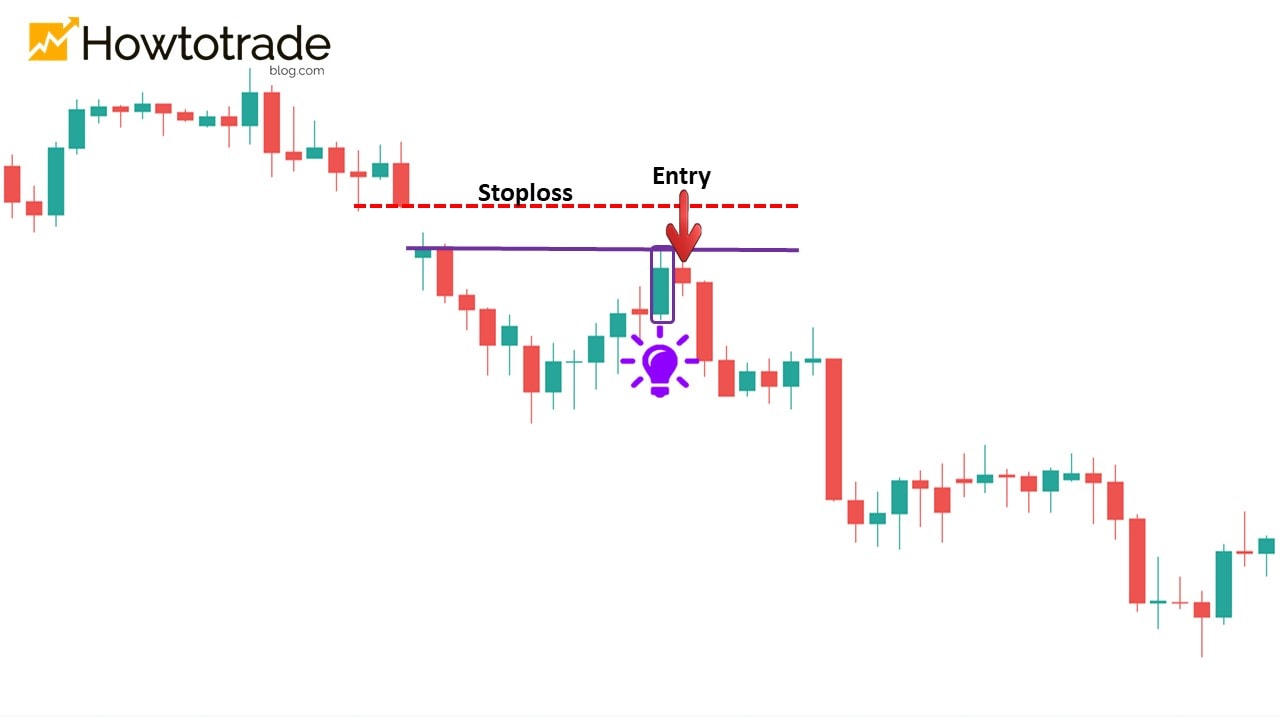

Open a SELL order with a Gap Down as follows:

+ Entry Point: When the candlestick finishes retesting the Gap.

+Stop-loss: At the upper level of the Gap Down.

+ Take-Profit: You can take profits when the price touches support levels that have been formed in the past.

The above transactions are for reference only which help you get acquainted with the Gap. You should only do them on a Demo account. In real Forex trading, combine Gap with other signals to increase the accuracy of your trade.